Arizona Tax Credits and Incentives

Check out what Tax Credits and Incentives are available to your growing business in Arizona

Arizona Tax Credits and Incentives

To continue economic growth, Arizona administers several incentive programs that could apply to both local businesses and out-of-state expansions into the state. Below is an overview of Arizona’s four most widely used incentive programs.

-

Quality jobs tax Credit (QJTC)

-

Qualified facility tax credit (QFTC)

-

Work opportunity tax credit (WOTC)

-

Research and Development tax credit (R&D)

Quality Jobs Tax Credit

The Quality Jobs Tax Credit is a non-refundable tax credit created to encourage business investment and the creation of high-quality employment opportunities in Arizona. This credit can be used to offset a company’s income or premium tax liability, with excess credits carried forward for up to five consecutive years.

Potential Benefit

The QJTC offers up to $9,000 of credit per net new job. The credit for each net new job is claimed over a three-year period in annual installments of $3,000 for an eligible business.

Eligibility Requirements

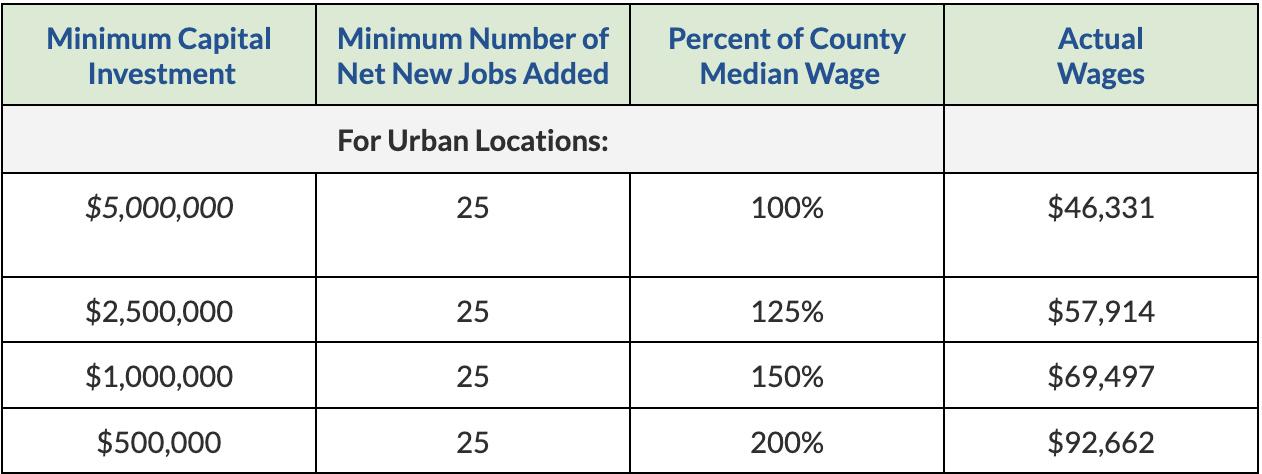

Companies making the minimum investment in Arizona and creating the minimum number of net new qualifying jobs can apply. Eligibility qualifications are different for urban areas as described below.

Urban Area – A location that is within the exterior boundaries of a city or town that has a population of 50,000 or more, and that is located in a county that has a population of 800,000 or more.

Qualified Facility Tax Credit (QFTC)

The Qualified Facility Tax Credit was established by the Arizona Legislature to promote the location and expansion of headquarters facilities or manufacturing facilities, including manufacturing-related research & development. The goal of the program is to encourage business investment that will produce high-quality employment opportunities for the citizens of Arizona and enhance Arizona’s position as a center for corporate headquarters, commercial research, and manufacturing. The Program accomplishes this goal by providing a refundable tax credit to taxpayers who are expanding or locating a Qualified Facility in Arizona.

Potential Benefit

The Qualified Facility Tax Credit offers a refundable income tax credit equal to the lessor of:

-

10% of the qualifying capital investment

-

$20,000 per net new full-time job at the facility if the total qualifying investment is less than $2 billion

-

$30,000 per net new full-time job if the qualifying investment is greater than $2 billion

-

$30 million per taxpayer, per year

Eligibility Requirements

A company may be eligible for Qualified Facility Tax Credit if it meets the following requirements:

-

Makes a capital investment of at least $250,000

-

80% or more of the property and payroll is dedicated to manufacturing, headquarters, or manufacturing R&D facilities

-

51% or more of the net new jobs must be at least 125% of the state’s median production wage in an urban location or at least 100% of the state’s median wage in a rural location

-

65% or more of the project sales or revenue are to customers outside of Arizona

-

Net new jobs only count after the project capital investment has begun

-

At least 65% of the health insurance premiums for all net new full-time jobs are paid by the applicant

Research and Development Tax Credit

The R&D program provides an income tax credit for increased R&D activities conducted within the state, which includes research conducted at a state university and funded by the company.

This program has a nonrefundable component and a refundable component. The nonrefundable component is administered by the DOR, and the refundable component is administered by the ACA. The maximum refund amount per taxpayer is $100,000 in a single year, with no cap for the nonrefundable credit.

Potential Benefit

A company may receive a nonrefundable income tax credit equal to 24% of the first $2.5 million in qualifying expenses, plus another 15% of qualifying expenses of more than $2.5 million for years 2011 through 2030.

In 2031, tax credit rates will decrease to 20% of the first $2.5 million in qualifying expenses, plus 11% of the qualifying expenses more than $2.5 million. An additional nonrefundable credit amount is allowed if the taxpayer made payments to a university under the jurisdiction of the Arizona Board of Regents, which allows a R&D tax credit of up to 34%. Any unused credit can be carried forward for 15 consecutive years.

A taxpayer qualifying for the nonrefundable tax credit and who employs less than 150 full-time employees worldwide can apply to ACA for a refund. The refundable tax is equal to the lesser of either:

-

75% of the current year’s tax credit minus the current year’s tax liability

-

Maximum refund amount on the certificate of qualification from the ACA

Eligibility Requirements

Arizona allows credits for research and development activities defined in Arizona Revised Statuses (ARS) Sections 43-1168 A1.

Work Opportunity Tax Credit (WOTC)

The Work Opportunity Tax Credit (WOTC) is a federal tax credit, ranging from $1,200 to $9,600, that is given to employers for each individual they hire from designated targeted groups. This tax credit is also dependent upon the new employee working a minimum of 120 hours in their first year.

Potential Benefit

Maximum available credits can range from $2,400 to $9,600 per new employee, depending on how the employee qualifies.

The credit value is determined by:

-

The group under which the employee qualifies

-

Number of hours worked

-

Wages earned during the employment period

Who can participate in the program?

Employers may submit applications to claim tax credits for new hires meeting the criteria for the specified target group. Current or rehired employees are excluded. The Work Opportunity Tax Credit (WOTC) is available to employers who hire people from specific target groups that experience barriers to employment.