Section 45L Energy Efficient Tax Credits

45L Energy Tax Credits

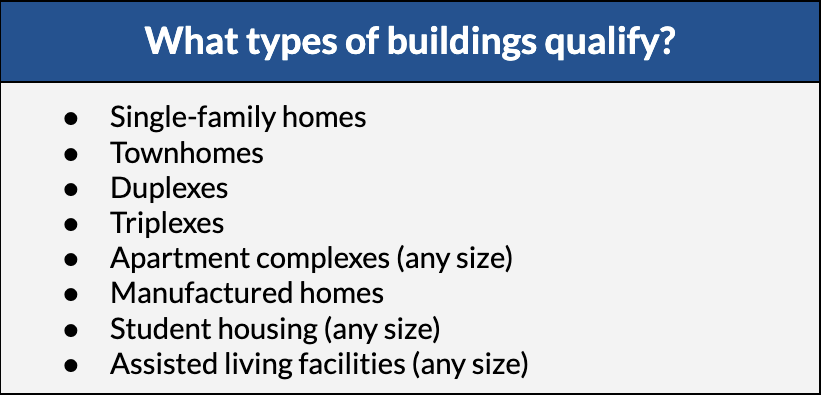

Section 45L of the Internal Revenue Code (IRC) allows developers, builders, and homeowners to claim tax credits for energy-efficient residential properties that are newly built or substantially remodeled. A broad range of single-family homes and multifamily properties are eligible for this tax credit, which has recently been extended through 2032.

IRS Issues New Guidance Based on Inflation Reduction Act (IRA).

Meeting energy-efficiency requirements can make projects now eligible for a maximum of $5,000 per unit.

The Internal Revenue Service (IRS) recently issued new guidance with Notice 2023-65, surrounding the 45L Tax Credit that impacts how single-family, multifamily, and manufactured homes qualify for this Green Building Tax Incentive.

How do I Qualify?

The purpose of Section 45L is to encourage builders to use energy-efficient materials for the construction of residential buildings. Eligible properties do not necessarily have to be newly built homes; residential properties that have been substantially improved via remodeling or renovations are also eligible.

How much is the 45L Tax Credit worth?

The value of the 45L credit is calculated on a unit-by-unit basis, based on the per-unit sale or lease date. This means that developers who undertake phased construction projects may need to claim their credits over multiple years. You can only claim 45L credits for units that were sold or leased in the current tax year.

2023 and Later

Beginning in 2023, the 45L credit is available in different amounts for different property types. The value of the per-unit credit will also vary based on which energy-saving requirements each unit meets (ENERGY STAR or ZERH). Additionally, developers of multifamily properties can earn higher credits by meeting prevailing wage requirements.

Who can claim the 45L Tax Credit?

Only eligible contractors can claim the 45L credit. According to the IRS, the eligible contractor is the taxpayer who owns and has a basis in the residential building at the time of its construction.

Notably, there is no limit to the number of 45L tax credits each eligible contractor can claim. As long as the properties meet all requirements, you can claim tax credits for as many qualifying buildings as you own.